The Whole Product Concept is a simple concept for how we can think about our product offering from the perspective of our customers. It gives marketers a tool for thinking about the product from a different lens that is not stuck on the functional specifications.

While powerful for marketers, I believe this is a conceptual model that product managers should contemplate to be most effective at managing their products and delivering value to their customers.

Reference Note: I have been unable to determine the exact origins of this concept. However, there are a few people that have been credited with promoting its use for technology products. Those start with Theodore Levitt in The Marketing Imagination (1983) and a few years later Bill Davidow in Marketing High Technology (1986). Wikipedia says that it was introduced by Regis McKenna in 1985. ?

Recently, after publishing Kano Model and Execution Priorities, Scott Sehlhorst (@sehlhorst) reached out to me to discuss the journey from Discovery to Execution. In my article I had made a connection between Kano categorization and execution vs. discovery focused practices.

Sehlhorst, shared his perspective that Kano maps more neatly into the Whole Product concept from Theodore Levitt. I had to investigate and analyze this line of thought further. But first, I had to go back to Levitt’s original work because, while I had learned this model (or similar) years ago, I had never dug into its origins. Even my initial searches now lead me to multiple references of different authors of this concept, but Levitt appears as good as any. Minimally, he was a major early advocate.

What is The Whole Product Concept?

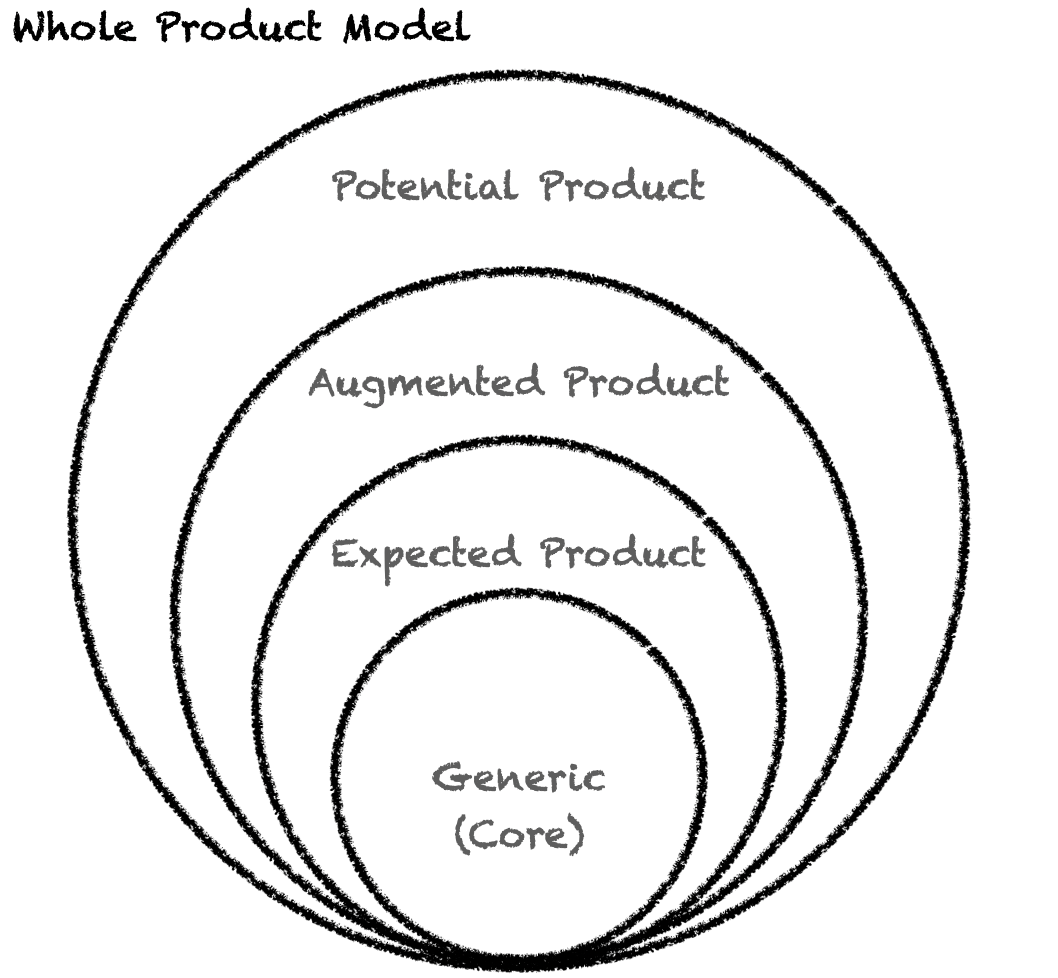

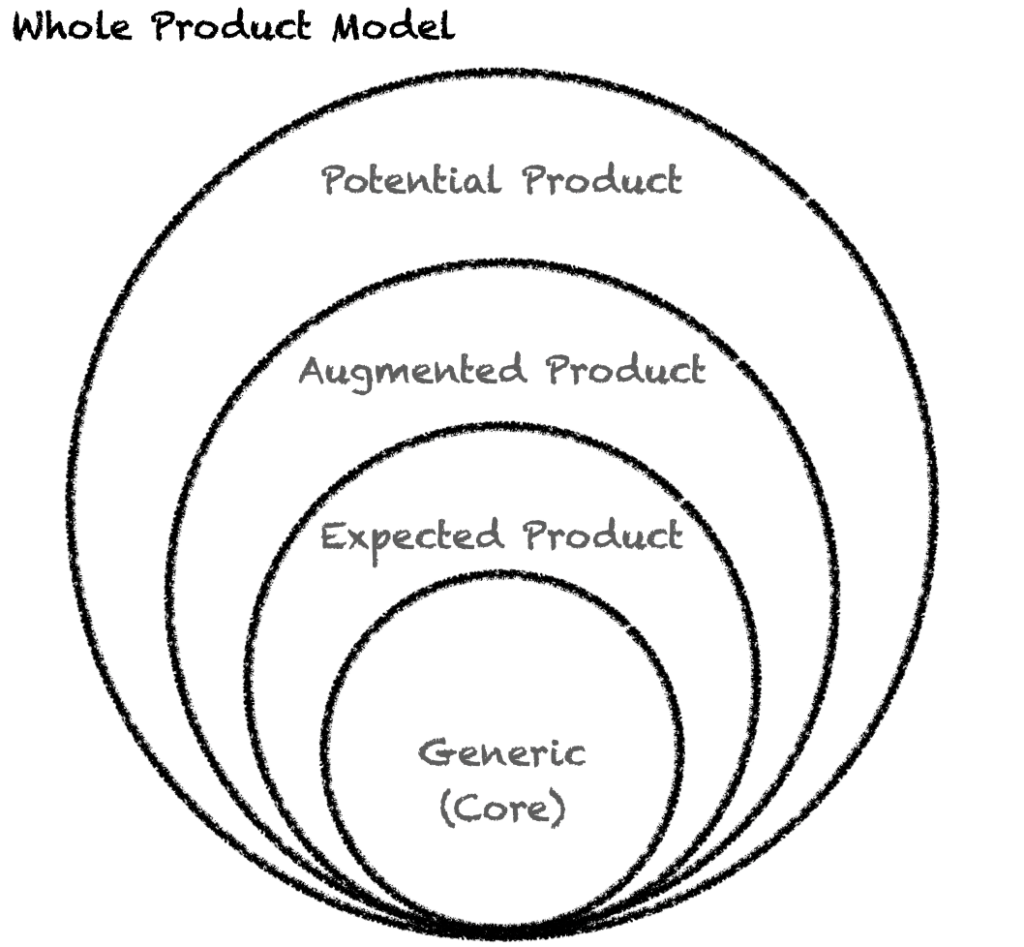

Let’s start with the conceptual model as Levitt describes it from the standpoint of the customer. There are 4 levels of product definition that should be considered for any product. These are the Generic, Expected, Augmented, and Potential Product. Typically these levels are depicted as layers expanding out, building on-top of one another.

The Whole Product Layers

- Generic Product: Specific functionality provided by the product.

- Expected Product: What customers think they are getting when they buy the product. Usually describes the scope of the minimally valuable product from the customer perspective.

- Augmented Product: Value-added products and services that make the product truly worthwhile to the customer.

- Potential Product: Enhancements and adjustments to the product that they customer imagines would make the product fully address their needs.

Generic Product

At the core of the product are the capabilities that can be objectively described. In Levitt’s early writing would refer to commodities to help illustrate the definition of a generic product as a starting point. Then through explaining further layers show how, even commodities, can be wrapped in additional value that goes beyond the generic product.

Taking a common technology example, we could look at a modern video game console as a generic product. It has some memory, networking capabilities, some expansion ports, a CPU, power, etc. All the basic features that the product manager provided clear requirements for engineering to build.

SIDE NOTE: If you ask an engineer to describe your product, they will likely give you the features of the generic product.

Expected Product

Frequently in technology products, what is contained in the generic product is not exactly what the customer minimally needs or expects to be included for them to derive value.

Case in point, with the gaming console example, you may need to purchase one or two controllers to derive even minimal value. You are also likely to require internet access and possibly a subscription to a game service.

As customers don’t often like to discover this gap, one of the key decisions product managers must make is how large this gap should be. For game consoles, they may provide some trial games and include a single controller. However, they won’t provide internet access today.

These decisions will change over time as a product matures. Sometimes, what is expected becomes a core of the generic product. Internet connectivity used to require optional hardware add-ons but is now table stakes for modern systems. On the flip side, some generic and expected feature may be removed.

Examples of expected features removed:

- Two controllers on video game consoles (now often just 1)

- CD-ROM drives on laptops

- Apple removed EarPods and charger from iPhone 12

In enterprise software products, we often see challenges where customers expect software to include certain features and benefits out-of-the-box that it does not. Product Managers need to balance the cost and complexity to include certain features versus the client satisfaction challenges if the gap is too great.

Further, when marketing products, it is a balancing act of deciding when to proactively inform prospective customers about gaps in the expectations you may frequently encounter. This is complicated by the leaders in particular product categories that create expectations of certain functionality in the products. Yet, as a product manager you may know such features do not actually provide the expected benefits or you have different features that can provide more value.

On the other hand, if you are the market leader, it is often a smart positioning tactic to create an expectation in the market for the features that your differentiated product uniquely includes.

Example: If you are the only CRM provider with AI based opportunity scoring, then you need to get the market to believe this is required.

Augmented Product

Beyond what is expected by the market, there is plenty of room to exceed the basics. In fact, if you want to be a leader in your product category you can’t just deliver the minimum.

Continuing on the video game console example, this means building out a high quality game service that continuously provides new and unexpected benefits to the customer.

In enterprise software, this can be around the on-boarding process, integrations, training, and continued education. Moreover, with cloud based services, products have the opportunity to provide amazing support and monitoring services. Even better, is a product that continually innovates bringing their customers more value.

Not too long ago, on premise perpetual licenses locked customers into a specific set of features until they paid for a license upgrade. Now, with cloud offerings, product managers need to contemplate adding new value to existing subscriptions or separating out new value with new associated fees.

Cloud vendors win when product pricing is structured in more of a win-win way. Vendors keep augmenting expected services with new value at the same fee. Customers, choose to continue expanding their usage because of the increased value. Through this expanded usage they ‘choose’ to pay more fees.

Smart product pricing strategy is built to align customer growth with continuously enhanced services. Over time this new value drives the market, setting customer expectations around your deeply differentiated value.

Potential Product

Customers don’t always buy the product as it exists today. In fact, with the level of investment enterprises must make to adopt new technology into their organization, it is critical that they see a bright future. Depending on the specific product category it is the norm to have companies spend 3-5x subscription fees to implement, train, and operationalize a software product within their organization.

For startups creating innovative new offerings (that may fall short in some basic expectation categories), it is absolutely critical to educate the customer on what the product can be in the future and the massive benefits they will derive by being there as it matures. Businesses are making a bet on the technology they adopt and it is our job a product managers to give them every reason to put their trust in us.

Specific buyers and sponsors of significant buying decisions, are often putting their own reputation and jobs on the line, to go with new unproven vendors and offerings. The potential future is sold by demonstrating trustworthiness on today’s value proposition while painting a picture of the future they want to be a part of.

Conclusion

Too often product managers are thinking like engineers about the Generic (Core) Product. To elevate the value we provide to the organization, we must take a step back and consider the Whole Product. It works much like a problem reframing exercise. Take a step back and empathize with your customers and how they perceive your product and that of competitive alternatives.

Whole Product acts as both a defensive technique and an offensive tool for getting ahead of the market. This will unlock opportunities to rethink roadmap priorities, pricing, and market positioning.

Recommended

- Marketing Success Through Differentiation – of Anything by Theodore Levitt

- The Whole Product (video interview) – Steve Blank

- Marketing is Everything – Regis McKenna

- Whole Product Concept – A Quick Guide for the Expert PM – 280 Group article