A few weeks ago I wrote an article on the continuum of product strategy from Discovery to Execution focus. In that article I spoke about Execution dominant product strategies, but not much about what they look like. So in this issue I am going to dig back into that topic and discuss why some take that approach and how they tackle it.

How do you Out Execute the Competition?

Most new products enter the market into existing product categories. As I have discussed previously, this makes a lot of sense. There is already proven demand to solve a problem and your view is simply that either the market is big enough for another player or you believe you can steal market share from the existing competition.

Often, a startup may be built around a product idea they believe is novel, but as they progress they discover that there are others already building or delivering a similar solution to market. If customers are aware of the alternatives but still contemplate the new solution, you know there is room to out execute.

For established businesses, frequently they may have an existing product that competes in a well developed product category. If they decide to extend their product line, frequently it is because they have seen demand in the market when an existing competitor did the same.

Existing Product Categories

These are all scenarios where companies decide to compete within an existing product category. A product category is a defined market need that met by one or more product solutions. A product category creates expectations by market participants that minimally include:

-

Problems it solves

-

Features

-

User Experience

-

Pricing

-

How it is marketed, sold and supported

For example, Core HR Software, is a well-established product category. Business customers looking to manage payroll and benefits would expect any product in this category to help them address these needs. Further, based on a review of leading vendor products in the category they will come to expect a certain set of features, user experience, and pricing.

What this means for any new product entering this product category is that it must meet most of these same criteria. This is considered table stakes to successfully enter this product category.

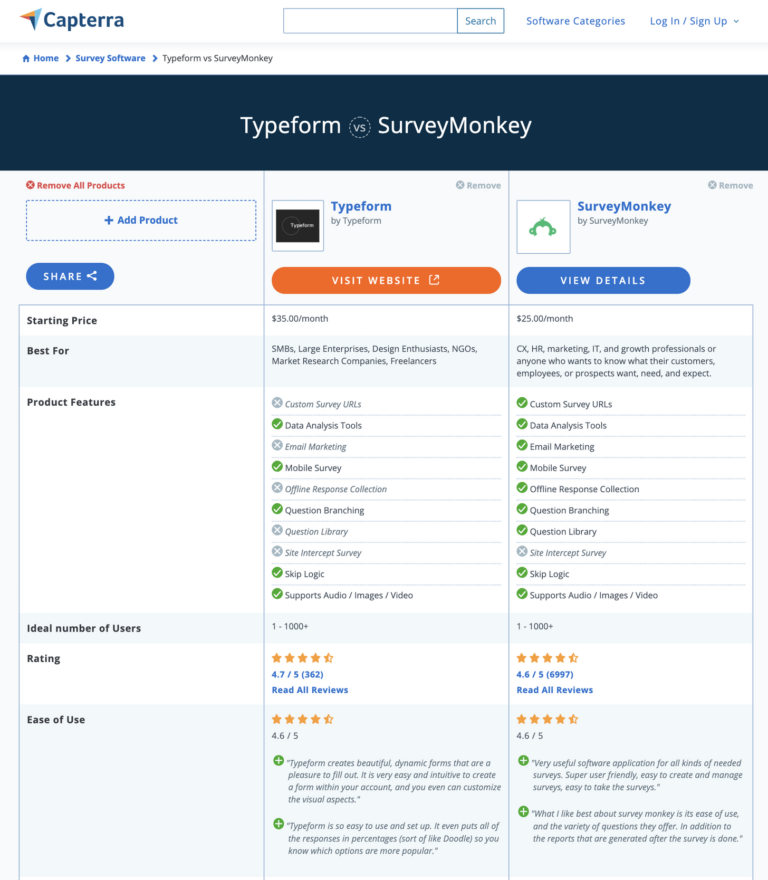

Many product categories (and sub-categories) exist. Every product exists within either a pre-existing category or one they created. There is no truly comprehensive list of these categories but some business product comparison sites, like G2 and Capterra, make an attempt.

When you compare two or more products within a category, they provide easy to compare feature lists and other attributes for potential buyers to differentiate. What features and other attributes get included in such lists are based on some subjective analysis of each product category.

Benefits of entering an existing Product Category

Developing a new software product and profitable business around it is an incredibly risky endeavor. Creating a new product category gives a business the huge benefit of not being judged by the expectations set by other market participants. This enables developers to focus on addressing a minimal set of market needs more quickly.

Since creating a new product category sounds so much cheaper to get to an initial product, why would anyone enter an existing Product Category? Below are three typical reasons.

1. Discoverability

Aligning your product with an existing product category make it easier to be found by market participants.

Industry analysts will want to learn about new products in a product category they cover. If you do well with them, they will include you in their market reports and discussions.

Potential customers, will almost always consider multiple products that solve a defined problem.

Identifying marketing channels, like events, online news outlets, and social media groups is easier as the groundwork has already been laid by incumbents who invested heavily to develop a market.

2. Reduced Discovery Risk

As a new product there is a lot of uncertainty. Some of this uncertainty can be reduced through entering an existing product category and even copying existing business models.

If other companies have solutions that the market is buying and getting demonstrable benefit from, you have some evidence of what is considered valuable by the market.

When some products in the category are significantly more successful than others, you have additional insights into how to prioritize new product investments and build a viable business model.

Finally, because someone else has successfully built the technology, it is evident that it is technically feasible. Many brand new product categories don’t have this luxury.

3. Portfolio Considerations

There are many reasons to enter a specific product category that go beyond thinking about a single product in a vacuum – one such consideration is portfolio mix and solution suite positioning.

For example, if you are already in a Product Category and your major competitor is launching a complementary product this may hurt your existing market position. As such, it may make a lot of sense to match the new competing offering to negate the broader solution benefit your competitor is now able to position on.

Approaches to Out Execute

Once you determine to go into an existing product category (or find yourself in one), then you should be working on Out Executing the competition. Investors reviewing new startups, think about this too. If they see a company seeking funding who is doing something others have tried, they ask:

Why you and not the competition?

Why now?

There are several ways you can out execute and you should probably work on all of them. Fundamentally, almost any strategic or operational function within the business can become a unique strength that puts you ahead.

Leadership Team

If you are bringing a new product to market as a startup or existing company, the right leadership team can help make a huge difference. Have they built successful solutions into this product category previously? Do they have the right mix of capabilities to equal or better the competition?

⭐️ Dave Duffield founded Workday after successfully building multiple prior HR businesses greatly increasing their odds of success in a crowded category.

HR & Talent Management

How you recruit, develop, and retain the best talent for your organization is a critical operational process. This includes intentionally developing a diverse & inclusive organization and effective product culture.

Great product companies encourage experimentation which often leads to learning through finding many ways that don’t work. Teams should be the focus of objectives as they are the vehicle through which the organization executes with intention aligned with strategy.

A great tool to encourage this type of culture is through OKRs.

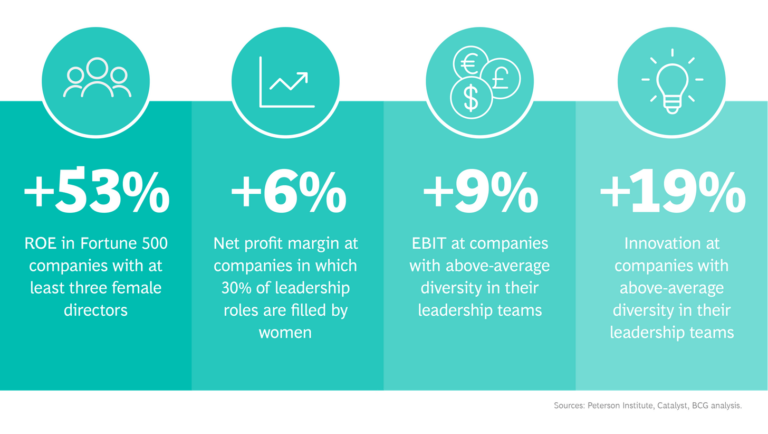

⭐️ According to BCG, not only is a diverse organization the right thing to foster, but it outperforms less diverse business.

Product Development and Delivery

Product Management, Design, and Engineering personnel want to work in an environment that they believe supports modern practices like customer development, Agile methodologies, and CI/CD.

In a product category where there is a lot of known problems and solutions, the focus is not on discovery entirely new solutions but is much more focus on the details. Creating an outstanding customer experience and user experience is often a critical differentiator.

-

Is it lower friction to on-board and start getting value from your product?

-

Do users love to use your product?

-

Do users rate it higher in terms of quality and performance in published reviews?

Organizations that do not strongly encourage, continuous learning, effective user research, product analytics, or lean/agile development is actively working against bringing the best product to market. Even in mature product categories modern practices help achieve superior results.

⭐️ Zoom usage has sky-rocketed during the coronavirus pandemic both due to its freemium model and superior user experience. Many video conferencing products existed before them and some even copied their freemium model quickly. Their magically simple user experience is what has become the lasting area of sustainable execution advantage.

Subject Matter Experts & Customer Success

Regardless of how high touch your product offering is, having the right people and processes engaged with your customers is critical to high satisfaction. In enterprise software, frequently, there is higher touch activities around integration, configuration, and best practices for a particular domain.

Having the right domain experts on your team can create the perfect icing on the cake, even if your product is just a me-to. Ultimately, your solution to your customers is the complete package of the technology and interactions that have with you to bring business benefits.

Do you have team members that are thought-leaders that customers want to connect to? Do you have team members that have been on the customer side doing the same jobs in the past creating deep empathy?

In the early days of a new product launched into an existing product category, the right Customer Success team and processes can fill huge expectation gaps in the product. Making the right investment allocations between Customer Success and R&D is usually a key differentiator in complex or highly regulated markets, like FinTech, Aerospace, and Pharma.

Sales & Marketing

When introducing a new product into an existing product category, it is possible to out execute incumbents through sales and marketing – both strategy and tactics. The specifics of what can work differs from one product category to the next.

Some approaches taken to win market share in a defined product category include:

-

Pricing and Discount Strategy – Set introductory prices slightly lower than the main competition without significantly compromising customer lifetime value.

-

Licensing – Historically, business software has shifted from perpetual licenses, to term, to subscription based contracts. Each of these shifts appealed to the buyers and were difficult for incumbents to make the transition to due to how they manage everything from financial reporting to sales compensation.

-

Marketing strategies like Free Trials and Freemium offerings. All else the same, these approaches can steal qualified leads from the competition.

-

Partnerships can help market, distribute, implement, and gain customer success more efficiently than direct sales.

-

Affiliate programs are a form a sales partnership that compensate affiliates for new business they bring in for your product. Generally used for lower cost subscription products, it can be a good tool for inexpensively building pipeline for a new product.

What I don’t like about using sales and marketing approaches to gain new product traction in an existing product category is that they are difficult to defend. Most incumbents can adopt these approaches if they appear to work.

Further, many of these approaches will work better for the incumbent than the new product given the existing brand recognition and existing market presence they can leverage.

While not always the case, these approaches should be considered a great tool for gaining sales momentum but eventually other tools like superior HR or Product Development Practices are more sustainable.

Conclusion

While most startups like to think they are defining new product categories, most products entering the market are actually positioned into existing categories. While less likely to change the world, this approach can help reduce a lot of risk inherent in new product development.

The downside is that you must invest more up-front to effectively compete and out-execute the incumbents. None of these areas of strategic or operational execution is a panacea as the incumbents can also invest there. The goal is to simply gain some of the market share and momentum while you build more defensible differentiation over time — but first, invest in the table stakes.