Startups and those engaged in new product development focus a great deal around the concept of Product/Market-Fit. If the job of a Startup is to discover a viable business model, then finding Product/Market-Fit is considered a critical milestone on that journey.

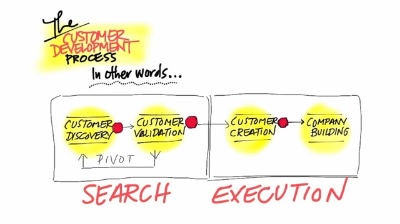

One of the core implications of discovering PMF is that, once achieved, you can now pour fuel on the fire and watch it grow. In startups, this often means that prior to Product/Market-Fit you are directing investment primarily to the Search phase of the Customer Development Process.

Once you have achieved the special milestone, you then shift into the Execution Phase that entails Customer Creation and Company Building. This shift, for Startups, may often be tied to a new investment round where the CEO declares that this new infusion of capital will be used to scale the sales and marketing effort of the business.

The problem is that this milestone is actually a moving target. Not only does it move before you hit the target, but it can also be pulled right out from under you AFTER you have successfully concurred it.

In my last article I questioned whether one actually needs a product to achieve Product/Market-Fit. (Spoiler Alert: You do if you want to reap the benefits of PMF). For background on what PMF is, check out my article.

Once you have achieved the special milestone, you then shift into the Execution Phase that entails Customer Creation and Company Building. This shift, for Startups, may often be tied to a new investment round where the CEO declares that this new infusion of capital will be used to scale the sales and marketing effort of the business.

The problem is that this milestone is actually a moving target. Not only does it move before you hit the target, but it can also be pulled right out from under you AFTER you have successfully concurred it.

How Can Product/Market-Fit Be Lost?

We know that PMF is difficult to achieve but falsely assume that once we get there we can shift entirely to the execution mode. So it may be helpful to think about scenarios where PMF is theoretically achieved but then lost as a guide.

To help identify these scenarios, let’s look at the two building blocks for the Search phase from Steve Blanks model.

-

Customer Discovery. Is there a group of customers that have a common problem that would be valuable to solve?

-

Customer Validation. Do customers believe your proposed solution matches the need you discovered?

Theoretically, it can be possible to complete both of those activities and then have the results change afterward. Either the problem can go away/change or the solution may no longer fit with the customer.

Problem Changes or Goes Away

Let’s think first about scenarios where a problem may go away. This could be something that changes because of technology advances, environmental factors, or timing.

Examples:

-

Y2K Bug. After Y2K, the market problem disappeared.

-

VHS Video Tape Distribution. Thanks to streaming, there is no longer a problem with manufacturing and distributing physical tapes.

-

CD Ripping. People don’t buy CDs anymore, let alone need to get the music off them onto their computers or MP3 players.

-

Tax Filing. Ever tax year we have a different problem to solve.

-

Password Managers. If you live wholly in the Apple ecosystem, your MacOS, iOS, iPadOS, tvOS, and watchOS have made the need for third party services moot for many. There are good enough capabilities now embedded and shared across your platforms.

A very common scenario for software products is that the problem context can change when underlying platforms change. For example, nobody needs to better manage Contacts on a PalmOS or Symbian portable devices. They may still have the need to manage their contacts efficiently, but the specific context of that need has changed.

Customers No Longer Validate a Solution

Beyond the problem changing, customers can sometimes determine the a specific solution is no longer a valid option. Most often this can be due to changes in market expectations.

Examples:

-

VHS Video Tapes. No longer relevant compared to streaming alternatives.

-

Client-Server ERP application. Displaced first by web based deployed using on-premise servers. Now displayed by cloud based SaaS. Buyers don’t want to maintain IT infrastructure where it does not provide strategic advantage.

-

Encyclopedia (printed) volumes. Britannica went from 100,000 units in 1990 to 3,000 by 1996 due to CD-ROM competition before killing the 244 year old product in 2012. Nobody wanted to buy them any more.

-

Video Games and Social Media apps. While some have proven staying power many of these apps, after generating massive windfalls for their creators, become suddenly displaced by the next hot thing.

-

iOS apps. Updates to Apple terms and conditions can cause apps to be rejected or removed. This makes them not a viable solution to the majority of customers.

In fact, most successful products will grow their customer base and market share to the point that eventually it invites new entrants to take a piece of their business. As you grow and mature, you inevitably lose focus on most effectively satisfying subsegments of your customer base.

Insights for New Products

I believe that Product/Market-Fit is a very important point-in-time to celebrate and shift how you invest in your business. Importantly, while it can be difficult to assess if you have obtained PMF, when you do reach that point it is not a time to stop working on improving it. It is not only possible to lose PMF, but likely over time.

For many new products, exploiting changing customer expectations, leveraging modern technology, or taking a different approach to solving a problem thought to be well-understood is the start. By crafting a better perceived solution, you can effectively break competitive Product/Market-Fit for a slice of the existing market that may be underserved.

Companies like Superhuman, Robinhood, and Zoom show what’s possible here.

The lesson for the incumbents is, once again, don’t rest on your laurels. Product/Market-Fit is transient.