For many companies, you are deep into annual investment planning and thinking about how to allocate your scarce resources best drive toward your business objectives for the next year. This often involves deciding which key growth initiatives to focus on for the coming year, with various stakeholders all lobbying for their project to get the available on-top funding.

In this article, I want to share a simple visual to help illustrate how critical it is to consider a more focused approach to your investment and resource allocation planning. Everyone has heard about the benefits of being focused but it is still a difficult thing to do in practice. My simplified visual may help you think about focusing as a tool to execute initiatives more efficiently to yield the desired business results, not as a tool limiting business potential.

Once ingrained in your strategic planning approach, you can also apply these concepts to any situation you have to prioritize investment efforts on any scale. From portfolio-level investment decisions, to which customer project to tackle first, to feature backlog prioritization, all the way down to determining which defects to tackle first.

Focus – Simply Defined

As a business, you have scarce resources but potentially many ways in which to allocate them to achieve your objectives. To most organizations, it is clear that you cannot invest in every project at the same time, so it comes down to prioritizing which investments will yield the best results for the business. If doing this with intention, organizations will develop their business objectives, sometimes referred to as strategic intents, and a set of initiatives to consider investing in.

The business objectives provide context for making prioritization decisions along with a portfolio management strategy like Geoffrey Moore’s Three Horizons Model that looks at investment decision along with different planning timeframes (1 year, 1-3 years, and 3-5 years). Due to a number of unknowns such as exact effort, return on investment, ability to execute, and externalities the selection process is never easy. Frequently with a large organization, you arrive at a point where there are multiple initiatives with similar potential to positively impact the business.

Focus is “a central point, as of attraction, attention, or activity” – Dictionary.com

This is where things get tricky and management needs to be bolder. If you are a small organization with only one product team to allocate, you can readily understand that focus means picking a single initiative. However, larger organizations may have multiple product teams, additional investment money to add new hires, partnerships to leverage, outsourcing, and supporting resources to draw from. Coupling this with the natural sense that working on multiple valuable initiatives feels like more will be accomplished.

There are indeed many valid reasons to invest in multiple initiatives concurrently. The biggest valid reason to me is that of high switching costs for teams, especially on short term planning horizons. This means that within your portfolio, you will frequently have some “run the business” type of investments, that are geared to optimizing execution, CSAT, and business results within the next year. However, even within the next year, many organizations are making on-top investment allocation decisions that are designed to significantly improve current execution or lay the ground-work for Horizon 2 or 3 initiatives.

Focus on these initiatives will yield the maximum return on investment for the business while reducing execution risk, and enabling greater business agility over time.

Investment Focus Example

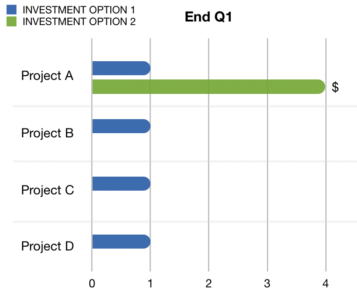

To illustrate the potential benefits of focusing your portfolio investment decisions, let’s take a simplified case of 4 competing investment initiatives. Let’s consider that it is time for annual planning and your four product lines (A, B, C, and D) each proposed an initiative that they believe will significantly drive revenue growth for their portion of the business upon completion.

Each initiative is projected to return X$ of revenue on a quarterly basis upon completion and require an investment of the equivalent of 48 man-months (4 FTE, 1 year) to complete. The business agrees to fund all 4 initiatives with the goal of seeing results by the end of year 1, which will equate to 4X$.

Most organizations would be extremely happy with this level of focus and the potential return on investment. They have four projects that will return significant value. The management responsible for each product group will be happy because they will get their additional resources and drive their top priority new initiative as fast as possible.

Yet, the business could focus more…

Consider instead, if the business decided to fund all 4 initiatives but only one at a time with the same investment. Theoretically, this level of investment will enable Product Line A to complete their initiative, Project A, in just 3 months! At the end of three months, Project A will return X$ in new revenue. By the end of the year, this will total 4X$ in revenue, which will be the same total revenue expected if the business had allocated funding across all four initiatives simultaneously.

However, the new teams shift their attention to Product Line B after 3 months, enabling them to complete Project B, by the end of Q2, adding another new revenue stream of X$ per quarter. Then again shifting to Project C in Q3 and Project D in Q4, each generating X$ in revenue upon completion. The results yielded by this level of project execution focus are 10X$ (4X$ Project A + 3X$ Project B + 2X$ Project C + X$ Project D). This is an astonishing 2.5X the revenue projected to come if all four ‘top’ priority initiatives were allocated to concurrently.

Focusing on a single initiative yields 2.5x revenue.

The real-world is not this simple

I understand that my example is overly simplified. It is to drive home the point visually that extreme focus can yield incredible business results. You can see this time and again business that focuses on very limited product offerings being able to grow into gigantic businesses. Let’s explore some of the complexities glossed over in my example.

Revenue does not arrive the instant a project is completed.

For most types of businesses, this is absolutely true. We could equally imagine a model where the revenue is delayed by a quarter after the project is completed. Within the first year, this means that no revenue should be expected if the company pursues investment in all 4 initiatives at once. This gives further support for focusing on one initiative at a time.

Product Initiatives find deliverable value in less than 1 year

For those that follow lean startup practices closely, you may be aghast at investing resources for an entire year before delivering something of value to the market. Especially in SaaS businesses, this seems like a very long time. This is absolutely true and all businesses should be striving to deliver value sooner to validate their assumptions and adjust as needed over time. The reality is that in order to make decisions on which portfolio investments to make, some level of investment and financial return projections need to happen. Otherwise, all investments will naturally be split to the four example product lines leading to clearly sub-optimal business results.

For the sake of this example, we can assume that some initial discovery work has been done ahead of this allocation decision that tested critical value hypotheses and validated assumptions sufficiently to progress to this larger investment commitment.

Unrealistic to believe that quadrupling a team size can deliver the work in ¼ the time

Agreed. Each project is going to have some ramp-up time as team members join the initiative, especially if they are new hires. The shorter the project duration of the project the greater the significance of this ramp-up time will be on the initiative.

You will need to consider this as you make your initiative prioritization and drive toward focused selection. I would argue that for projects on Horizon 2 (1-3 years) or Horizon 3 (3-5 years) the significance of this ramp-up should be greatly diminished and less of a factor.

Additionally, you need to factor in the potential impact adding a new revenue stream to the business faster will have on subsequent investments. What if a portion of the new revenue is used to increase resources to be allocated on subsequent initiatives?

New Product Initiatives Require Maintenance when completed

Yes. However, sometimes the new product initiative reduces maintenance needs on some other legacy product or capabilities that have been replaced. Another possibility is that the existing teams supporting the product line can sometimes absorb this new resulting capability into their regular maintenance investment level.

When the initiative truly results in expanded work for the product line to maintain (and continue to incrementally enhance) the added revenue from the early initiative delivery can be allocated toward this purpose. This competes with the desire to use that revenue to improve financial performance and accelerate the subsequent initiatives — but these are good management decisions to have to make.

Further, in the portfolio allocation example, at the end of the year, when all 4 initiatives have been completed, there will be 16 FTE available to reallocate where the business most needs them. They may go back to various product lines, support new initiatives, or, especially if they were outsourced, be reduced to improve margin results moving forward.

Risks are Exacerbated by putting on our eggs in one basket

I believe that this is one of the driving fears of executive management in making strategic portfolio investment allocation decisions. What happens if the project we are focused on is delayed or does not achieve the expected results?

Experienced managers have dealt with many project delays due to internal and external factors. It seems obvious that focusing risk on a single project will heighten that risk. There is some validity to this fear. However, the potential risks need to be assessed and evaluated in relative terms to the potential benefit of 2.5x better revenue during the year compared to even allocations. Even if it underperforms significantly you are likely to out-perform.

Further, some of the risks inherent across multiple smaller projects might be mitigated through both effective lean startup practices and scale. For example, by having your best people working together you may more quickly get through design or find critical assumptions to be flawed that kill or cause the project to pivot faster.

On a small team, personnel issues like extended leave or turnover can have a more profound impact on all schedules. Small teams also typically lack all required skills or knowledge on complex projects so they become dependent on more external support. External resources are always constrained and by not being dedicated to the project incur constant cognitive switching costs.

Lastly, often overlooked constraint is management and other stakeholder attention. When management is being most effective, they knock down obstacles and provide all the enabling support for teams to be most successful. When their attention is equally spread across 4 initiatives they are always less effective than when focused on a single initiative. The same is true with training support, customer success, sales, and marketing on what is coming and how to be best prepared for it. Focus helps all stakeholders achieve better results.

In Closing, Remember to Focus

I know I have grossly oversimplified the difficult task of deciding how to allocate scarce portfolio investments. However, by simplifying the problem, you can often learn quite a lot. In this case, I have demonstrated that you can return better business results by being hyper-focused across the business. Too often we fall in the trap of carving out multiple areas of the business then create priorities in each. This leads to the frequent situation of having multiple top priorities for the business which causes stress, dysfunction, and more from a lack of overarching focus.

While this may feel like you are achieving more, you will do so slower with more risk. Think holistically if you want to drive progress faster. This is most especially true when looking out beyond the next 12 months and funding those initiatives that will disrupt and change the business.